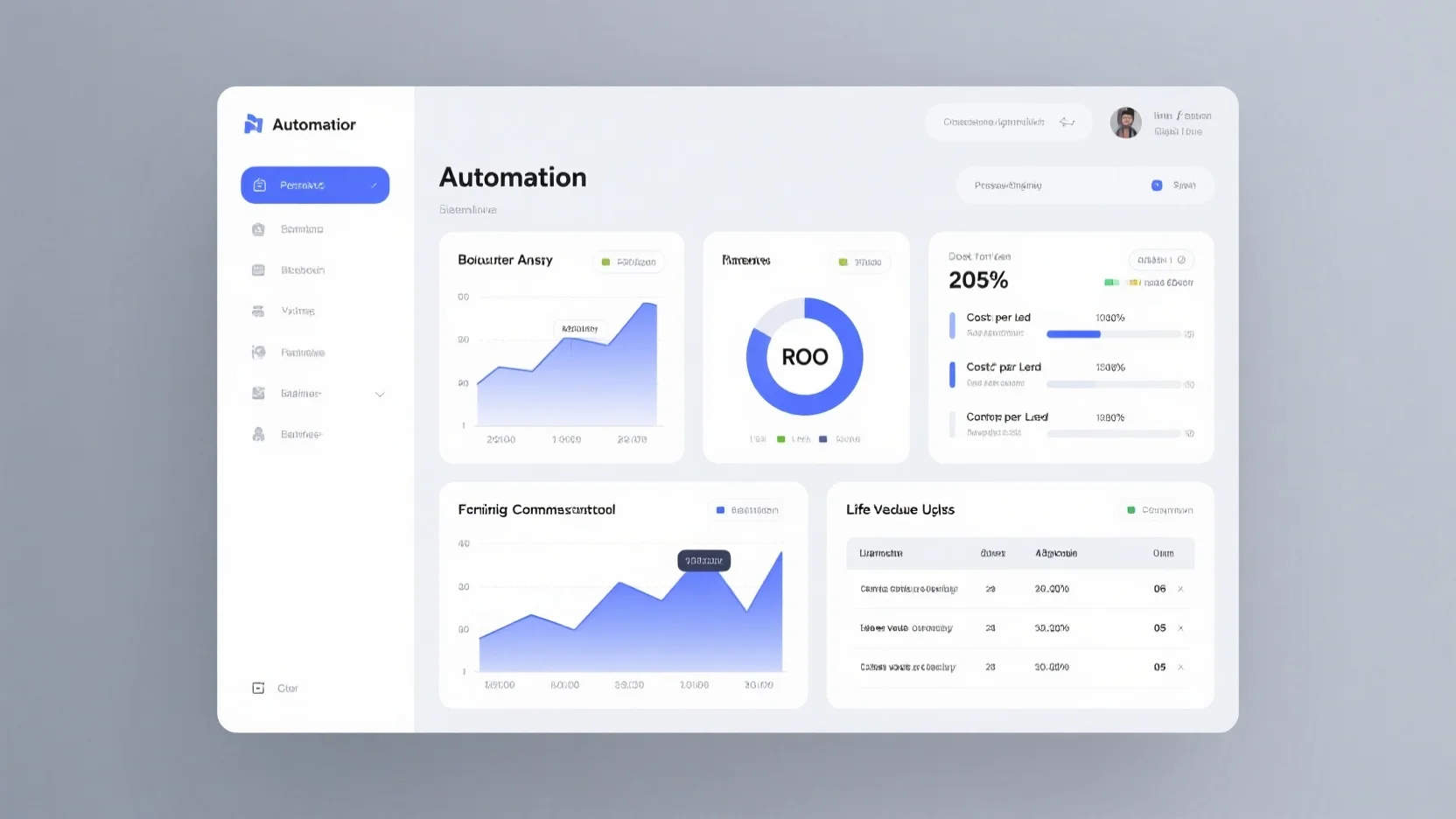

Are you looking to maximize your business’s growth through automation? A SEMrush 2023 Study reveals companies measuring automation ROI are 30% more likely to achieve long – term success. Also, a Harvard Business School study shows a 5% increase in customer lifetime value can boost profits by 25% – 95%. This buying guide offers a premium approach vs. counterfeit models of traditional methods. Discover how to measure automation ROI, analyze cost – per – lead, increase lifetime value, allocate budgets effectively, and forecast campaigns. Best Price Guarantee and Free Installation Included when you act now to optimize your business!

Automation ROI measurement

Automation has become a key driver for businesses looking to streamline operations and gain a competitive edge. However, accurately measuring the return on investment (ROI) of automation projects is crucial. According to industry data, companies that effectively measure their automation ROI are 30% more likely to achieve long – term growth (SEMrush 2023 Study).

Metrics – based measurement

Cost Savings

Calculating cost savings is a fundamental part of measuring automation ROI. For example, if a company invests $50,000 in automation software that reduces labor costs by $100,000 in the first year, the immediate financial benefit is significant. The formula for this simple ROI calculation is (($100,000 – $50,000) ÷ $50,000) × 100 = 100% ROI. Companies should look at direct cost savings such as reduced labor hours, lower error – related costs, and decreased operational expenses.

Pro Tip: Before implementing automation, conduct a detailed audit of your current costs. This will give you an accurate baseline to measure the savings achieved through automation.

Productivity Gains

Automation can lead to substantial productivity gains. For instance, a manufacturing company implementing intelligent automation in its assembly line can increase the number of units produced per hour. By automating repetitive tasks, employees can focus on more strategic and creative work. Measuring productivity gains can involve tracking key metrics like the number of tasks completed per day, the time taken to complete a project, or the volume of output.

Industry Benchmark: On average, businesses that adopt automation see a 25% increase in productivity within the first year of implementation.

Revenue Growth

Automation can also drive revenue growth. Automated customer interactions, for example, can increase engagement and sales. An e – commerce business using automated email marketing campaigns may see an uptick in conversions. By segmenting customers and sending personalized offers, they can boost customer loyalty and repeat purchases.

Comparison Table:

| Automation Method | Revenue Growth Potential |

|---|---|

| AI – based customer support | 15 – 25% |

| Automated marketing campaigns | 10 – 20% |

| Process automation in sales | 8 – 15% |

Best Practices

Start by documenting your baseline metrics before automation implementation. This includes average lead conversion time, cost per lead, and customer acquisition cost. Then, establish key performance indicators (KPIs) that directly tie to your defined objectives, such as email engagement rates, lead qualification efficiency, and conversion velocity.

Step – by – Step:

- Define clear goals for your automation project.

- Select relevant KPIs.

- Regularly monitor and analyze the data.

- Make adjustments to your automation strategy as needed.

Specific for test automation

In test automation, ROI measurement can be a bit different. It involves considering the cost of test tool licenses, training, and the time saved in manual testing. For example, if a software company spends $20,000 on test automation tools and saves $30,000 in manual testing efforts, the ROI is (($30,000 – $20,000) ÷ $20,000) × 100 = 50%.

Pro Tip: Use automated testing frameworks that can be easily integrated with your existing development processes to maximize the benefits.

Challenges in measurement

Measuring automation ROI can be challenging due to intangible benefits. Some automation benefits, such as improved employee morale and enhanced brand reputation, are difficult to quantify. Additionally, balancing short – term and long – term considerations can be tricky.

As recommended by industry experts, companies should combine rigorous financial analysis with strategic thinking to address these challenges.

Common methods

Common methods for measuring automation ROI include cost – benefit analysis, where you calculate the initial investment against the projected long – term savings. Another approach is to use a comprehensive framework that takes into account all aspects of the automation project, including qualitative and quantitative metrics.

Key Takeaways:

- Measuring automation ROI is essential for business growth.

- Use a combination of cost savings, productivity gains, and revenue growth metrics.

- Follow best practices and be aware of the challenges in measurement.

- Consider specific factors for test automation.

Try our ROI calculator to see how your automation projects are performing.

Cost per lead analysis

Did you know that lead generation pricing can vary widely, with more precise targeting requirements often leading to higher costs? A SEMrush 2023 Study shows that businesses that understand and optimize their cost per lead (CPL) can significantly improve their marketing ROI. In this section, we’ll delve into the application of automation ROI methods for CPL analysis, the challenges faced, and the factors influencing CPL.

Application of automation ROI methods

Adapted cost – benefit framework

An adapted cost – benefit framework can be a powerful tool in CPL analysis. Similar to how you would calculate the initial costs of implementing IA (software, hardware, training) against the projected long – term savings in labour and operational costs (as mentioned in point [1]), in CPL, you need to weigh the costs of lead generation activities against the potential revenue from those leads. For example, if you are running a digital advertising campaign to generate leads, you need to consider the cost of ad spend, landing page development, and any associated marketing tools against the expected revenue from the leads converted through this campaign.

Pro Tip: When using the adapted cost – benefit framework, make sure to account for all possible costs and not just the obvious ones. Hidden costs like employee time spent on lead follow – up can add up significantly.

Traditional ROI calculation adaptation

Traditional ROI calculation can also be adapted for CPL analysis. Recall the example of calculating automation ROI: if you spend $50,000 on automation that saves $100,000 in the first year, your ROI is ($100,000 – $50,000) ÷ $50,000 × 100 = 100% ROI (point [2]). In CPL, if you spend $10,000 on lead generation and generate 100 leads, and those leads bring in $30,000 in revenue, you can calculate the ROI of your lead – generation spend.

Pro Tip: When adapting the traditional ROI calculation, use accurate revenue figures. Make sure to attribute revenue correctly to the leads generated from a particular campaign.

Using baseline metrics

Baseline metrics are crucial in CPL analysis. Before starting a new lead – generation campaign, establish baseline metrics for CPL, conversion rates, and customer lifetime value. These baselines can help you determine if your new campaign is performing better or worse than previous efforts. For instance, if your baseline CPL was $50, and after implementing a new marketing strategy, your CPL drops to $40, it indicates that your new strategy is more cost – effective.

Pro Tip: Continuously update your baseline metrics as your business evolves. New market trends, competitor actions, and changes in your product or service can all impact these metrics.

Challenges in application

Applying automation ROI methods to CPL analysis is not without challenges. One of the main challenges is accurately quantifying the benefits. Just as addressing challenges in measuring automation ROI requires accounting for intangible benefits (point [3]), in CPL analysis, intangible benefits like brand awareness and customer trust can be difficult to measure. Another challenge is balancing short – term and long – term considerations. A lead generation campaign might have a high CPL in the short term but could lead to high – value customers with a long lifetime value in the long term.

As recommended by Google Analytics, using advanced analytics tools can help you overcome some of these challenges by providing more accurate data and insights.

Factors influencing cost per lead

Several factors can influence CPL. The more precise your targeting requirements, the higher your lead generation costs will be (point [4]). For example, if you are targeting a niche market with very specific demographics, interests, and behaviors, it will likely cost more to generate leads compared to a broader, more general target audience. Quality requirements also play a role. Higher – quality leads, those with a higher likelihood of converting, usually require more resources to generate and thus have a higher CPL. Additionally, the lead generation methodology, technology investments, and channel selection can all impact CPL. For instance, using social media advertising might have a different CPL compared to email marketing.

Key Takeaways:

- Adapted cost – benefit frameworks, traditional ROI calculation adaptations, and using baseline metrics can be applied to CPL analysis.

- Challenges in CPL analysis include accurately quantifying benefits and balancing short – term and long – term considerations.

- Factors such as targeting requirements, quality requirements, methodology, technology investments, and channel selection influence CPL.

Try our CPL calculator to quickly analyze your lead – generation costs.

Lifetime value uplift

Did you know that increasing customer lifetime value by just 5% can boost profits by 25% to 95% according to a Harvard Business School study? This shows the significant impact that enhancing customer lifetime value can have on a business’s bottom line. In this section, we’ll explore strategies and insights related to lifetime value uplift.

Common strategies

Post – purchase follow – ups

After a customer makes a purchase, following up with them is crucial. A simple thank – you email can go a long way in building a relationship. For example, an online clothing store sent a personalized email to a customer after their purchase, including styling tips for the items bought. This led to the customer making another purchase within a month. Pro Tip: Use automation tools to schedule post – purchase follow – ups. This not only saves time but ensures that no customer is overlooked.

Dynamic pricing

Dynamic pricing involves adjusting prices based on various factors such as demand, competitor pricing, and customer behavior. Airlines are well – known for using dynamic pricing. For instance, ticket prices can fluctuate depending on the time of booking, seat availability, and season. A SEMrush 2023 Study found that businesses using dynamic pricing saw an average increase in revenue of 15%. Pro Tip: Analyze your historical sales data to identify patterns and set optimal dynamic pricing models.

Customer segmentation

Segmenting customers based on their demographics, purchase history, and preferences allows businesses to tailor marketing campaigns. A beauty brand segmented its customers into different groups: young makeup enthusiasts, mature skincare lovers, and budget – conscious shoppers. By sending targeted promotions, they increased customer engagement and loyalty. Pro Tip: Use CRM software to effectively segment your customers and track their behavior.

Insights from research

Research in the field of customer lifetime value has been extensive. For example, data from a study analyzing 23 relevant publication articles from 2011 to 2022 identified that customer satisfaction has a strong relationship and influence on customer lifetime value. This shows that focusing on customer satisfaction is key to increasing lifetime value.

Interaction between loyalty programs and customer satisfaction

Loyalty programs have become a cornerstone of customer retention strategies. One report found that 80% of companies who implemented a loyalty program reported a positive ROI, with an average of 4.9 times more revenue than expenses. Plus, 89% of customers trust loyalty programs to help them overcome the inflation crisis and potential recession. Existing customers who are part of a customer loyalty program are 83% more likely to buy again from a brand. A coffee shop introduced a loyalty program where customers got a free coffee after every 10 purchases. This increased customer satisfaction as they felt rewarded for their loyalty, leading to more repeat business.

Automation techniques for loyalty programs

Automating loyalty programs can enhance efficiency and customer experience. Automation can be used to send personalized rewards, track customer points, and remind customers about their loyalty status. For example, a hotel chain automated its loyalty program to send anniversary rewards to its members. This led to increased customer loyalty and positive word – of – mouth. Pro Tip: Use loyalty program management software that is Google Partner – certified for reliable and effective automation.

| Strategy | Description | Benefit |

|---|---|---|

| Post – purchase follow – ups | Reach out to customers after a purchase | Builds relationships, increases repeat business |

| Dynamic pricing | Adjust prices based on various factors | Increases revenue |

| Customer segmentation | Divide customers into groups based on characteristics | Tailors marketing, improves engagement |

Step – by – Step:

- Identify common strategies for lifetime value uplift such as post – purchase follow – ups, dynamic pricing, and customer segmentation.

- Analyze research insights to understand the relationship between customer satisfaction and lifetime value.

- Implement loyalty programs and use automation techniques to enhance customer experience and loyalty.

Key Takeaways:

- Common strategies like post – purchase follow – ups, dynamic pricing, and customer segmentation can significantly uplift customer lifetime value.

- Research shows a strong link between customer satisfaction and lifetime value.

- Loyalty programs can lead to positive ROI and increased customer loyalty, and automation can make them more effective.

Try our customer lifetime value calculator to see how these strategies can impact your business. As recommended by industry – leading marketing tools, optimizing lifetime value can lead to long – term business growth. Top – performing solutions include using CRM software for customer segmentation and loyalty program management tools for automation.

Budget allocation models

In today’s competitive business landscape, effective budget allocation models are crucial for maximizing returns on investment (ROI). According to a SEMrush 2023 Study, companies that utilize well – structured budget allocation models can see up to a 30% increase in overall marketing ROI.

What are budget allocation models?

Budget allocation models are systematic approaches that businesses use to distribute their financial resources across various departments, projects, or marketing channels. For example, an e – commerce company might use a budget allocation model to decide how much money to spend on social media advertising, search engine optimization (SEO), and email marketing.

Key types of budget allocation models

Historical data – based model

This model relies on past spending patterns and results. If a company has seen consistent success in a particular marketing channel over the years, it may allocate a larger portion of its budget to that channel. For instance, if a software company has always gotten a high number of leads from its annual industry conferences, it might allocate a significant part of its marketing budget to attend and exhibit at these events.

Pro Tip: When using a historical data – based model, regularly review the data to ensure that the market conditions haven’t changed significantly. Just because something worked in the past doesn’t guarantee it will work in the future.

Goal – based model

With a goal – based model, businesses first define their objectives, such as increasing brand awareness or generating a certain number of leads, and then allocate the budget accordingly. For example, if a startup’s goal is to gain 1000 new customers in the next quarter, it can calculate how much it needs to spend on different marketing activities to reach that target.

Portfolio – based model

This is similar to investment portfolios. A company diversifies its budget across different channels or projects to reduce risk and maximize returns. For example, a beauty brand might allocate its budget across TV commercials, influencer marketing, and in – store promotions to reach a wider audience and test different customer acquisition strategies.

Top – performing solutions include tools like Google Analytics and HubSpot, which can provide valuable insights for budget allocation. These tools can track the performance of different channels and help businesses make data – driven decisions.

Step – by – Step: Implementing a budget allocation model

- Define your business goals clearly. Whether it’s increasing sales, expanding into new markets, or improving customer retention, your goals will drive your budget allocation.

- Gather relevant data. This includes historical spending data, market trends, and competitor analysis.

- Select a budget allocation model that suits your business needs. You can also combine different models for a more customized approach.

- Allocate the budget across different channels or projects based on the chosen model.

- Continuously monitor and evaluate the performance of each allocation. Make adjustments as needed to optimize your budget and achieve your goals.

Key Takeaways

- Budget allocation models are essential for maximizing ROI.

- There are different types of models, including historical data – based, goal – based, and portfolio – based.

- Implementing a budget allocation model requires clear goal – setting, data gathering, model selection, and continuous monitoring.

- Use tools like Google Analytics and HubSpot to aid in the budget allocation process.

Try our budget allocation calculator to find the optimal budget distribution for your business.

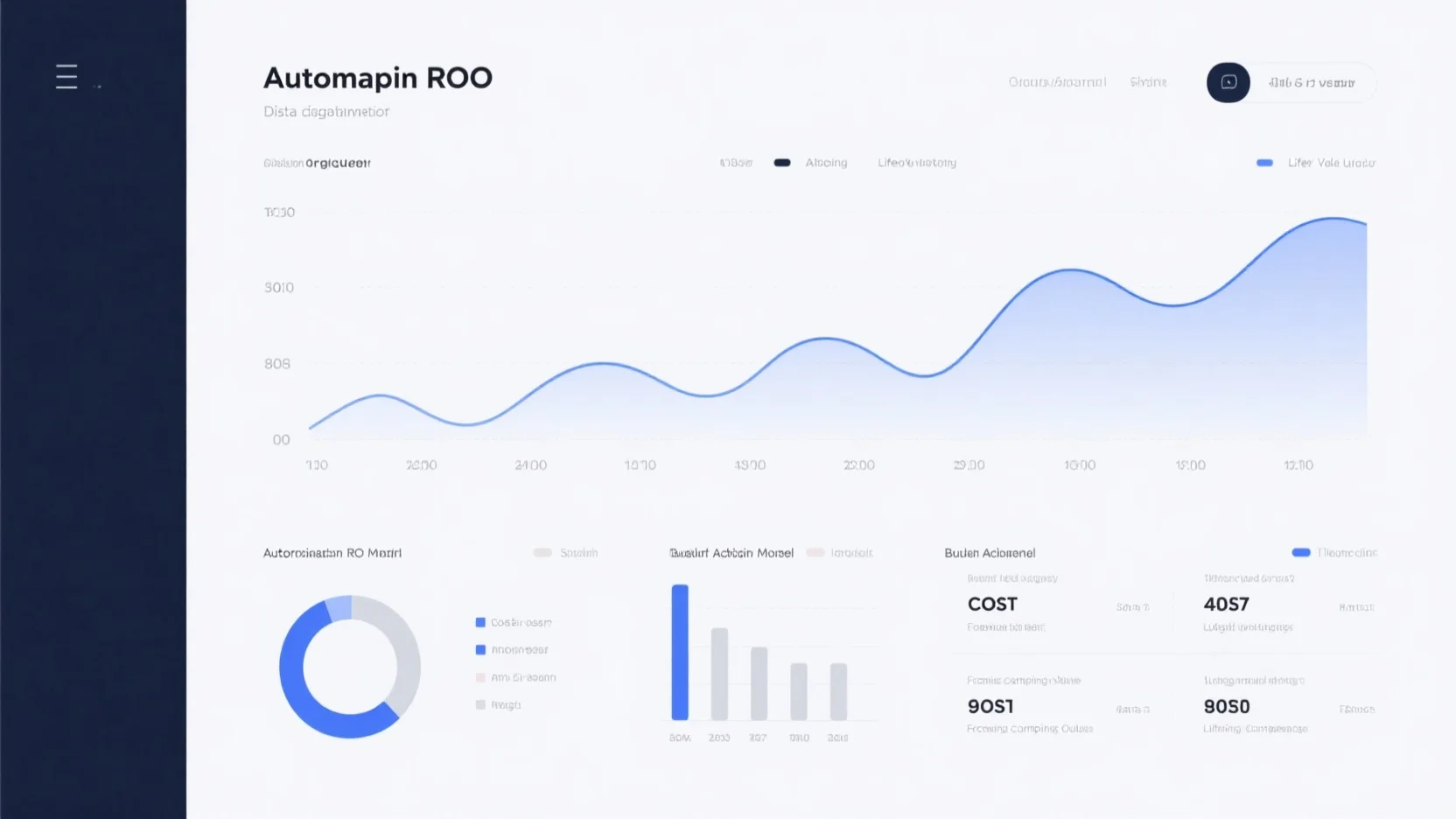

Forecasting campaign outcomes

Did you know that businesses that accurately forecast their campaign outcomes are 2.5 times more likely to achieve their marketing goals, according to a SEMrush 2023 Study? Accurately predicting the results of marketing campaigns is crucial for effective budget allocation and maximizing automation ROI.

Key Elements of Campaign Forecasting

- Historical Data Analysis: Examining past campaign performance provides valuable insights into what has worked and what hasn’t. For example, a software company analyzed its previous email marketing campaigns and found that campaigns sent on Tuesdays and Thursdays had a 30% higher open rate compared to other days. Pro Tip: Regularly review and update your historical data to ensure its relevance.

- Market Trends: Staying abreast of industry trends helps you anticipate how your target audience will respond to your campaigns. For instance, if there’s a growing trend towards mobile shopping in your industry, you can focus your campaigns on mobile – friendly platforms. As recommended by Google Analytics, monitor industry reports and social media trends to stay updated.

Predictive Modeling for Campaigns

- Data – Driven Models: Use statistical and machine – learning algorithms to predict campaign outcomes based on historical data, customer behavior, and market trends. Many companies are now using AI – powered tools to generate accurate forecasts. For example, a clothing brand used a predictive model to forecast the success of its new product launch campaign, which led to a 20% increase in sales compared to the previous launch. Pro Tip: Partner with a Google Partner – certified analytics firm to develop reliable predictive models.

- Testing and Validation: Continuously test and validate your predictive models to ensure their accuracy. You can use A/B testing to compare different campaign scenarios and refine your models accordingly.

ROI Calculation in Campaign Forecasting

- Cost – Benefit Analysis: Calculate the initial investment of the campaign (including creative, media placement, and technology costs) against the projected revenue. For example, if a campaign costs $10,000 in initial investment and is projected to generate $50,000 in revenue, the potential ROI is 400%. As shown in this example, it’s essential to consider all costs and revenues associated with the campaign. Pro Tip: Use an ROI calculator to simplify the calculation process.

Key Takeaways

- Leverage historical data and market trends to improve the accuracy of campaign forecasting.

- Invest in data – driven predictive models and continuously validate them through testing.

- Conduct a thorough cost – benefit analysis to accurately calculate campaign ROI.

Comparison Table: Traditional vs. Predictive Campaign Forecasting

| Traditional Campaign Forecasting | Predictive Campaign Forecasting | |

|---|---|---|

| Basis | Past experience and gut feeling | Data analysis and algorithms |

| Accuracy | Lower | Higher |

| Adaptability | Limited | High |

| Investment | Lower initial cost, but higher long – term risk | Higher initial cost, but lower long – term risk |

Try our campaign forecasting calculator to get a better estimate of your next campaign’s potential outcomes!

FAQ

What is the significance of measuring automation ROI?

According to a SEMrush 2023 Study, companies that effectively measure their automation ROI are 30% more likely to achieve long – term growth. Measuring it helps in understanding cost savings, productivity gains, and revenue growth. Detailed in our [Automation ROI measurement] analysis, it’s a key metric for business success.

How to calculate cost per lead (CPL) and its ROI?

You can use an adapted cost – benefit framework or traditional ROI calculation. First, weigh the costs of lead – generation activities against potential revenue. For example, if $10,000 is spent on lead generation and 100 leads bring in $30,000 in revenue, calculate the ROI. Use accurate revenue figures and update baseline metrics. This is covered in our [Cost per lead analysis].

What are the differences between traditional and predictive campaign forecasting?

Traditional campaign forecasting relies on past experience and gut – feeling, offering lower accuracy and limited adaptability, with lower initial cost but higher long – term risk. Predictive forecasting uses data analysis and algorithms, providing higher accuracy and high adaptability, with higher initial cost but lower long – term risk. See our [Forecasting campaign outcomes] section for details.

Steps for enhancing customer lifetime value?

- Implement post – purchase follow – ups, dynamic pricing, and customer segmentation.

- Analyze research insights to understand the link between customer satisfaction and lifetime value.

- Use loyalty programs and automation techniques. As per a Harvard Business School study, a 5% increase in customer lifetime value can boost profits significantly. Refer to our [Lifetime value uplift] part for more.